Looking at travel insurance and considering World Nomads for your upcoming trip? This World Nomads travel insurance review covers every question we could possibly think of.

World Nomads Travel Insurance Review: Is it Worth the Money?

When searching for travel insurance, you’ll likely see one name come up time and again. It’s World Nomads, and, if you’re curious about it, you’ve come to the right place.

After ten years of using them as my primary travel insurance, I finally decided to sit down and write a complete and honest World Nomads travel insurance review.

They’re one of the most popular travel insurance companies on the market—and it’s not hard to see why. When it comes to providing top-of-the-line coverage, the company is arguably the best choice for most travelers.

But it’s not necessarily the best choice for every traveler. This World Nomads travel insurance review will help you decide if World Nomads is the company you want to insure your next adventure.

What Is Travel Insurance?

Before diving into this World Nomads travel insurance review, let’s, first, talk about travel insurance in general, what it is and why you need it.

Put simply, travel insurance protects you against any unforeseen accidents, emergencies or financial losses you may incur while traveling.

A good travel insurance policy should include the following:

- Travel cancellations, interruptions and changes

- Stolen, lost, delayed or damaged baggage and property

- (Usually non pre-existing) medical treatments and expenses

Keep in mind that travel insurance is different from your normal health insurance plan. With domestic health insurance, your coverage is often limited overseas. And, in general, health insurance won’t protect against other unexpected events, like losing your iPhone, getting pickpocketed or missing your flight connection.

So why is travel insurance so important? Well, it doesn’t just protect your health. It protects your whole trip.

In other words, it’s smart to travel with both regular health insurance and travel insurance because they’re totally separate entities.

Is Travel Insurance Worth It?

So, why do you even need travel insurance in the first place and is it worth it?

When it comes to planning a trip, purchasing a travel insurance policy may be the last thing on your mind (and in most cases, for most travelers, it actually is!). Maybe you’re not concerned about the relentless blizzard that could cancel your flight. Or perhaps you assume that the chance of getting pickpocketed on the subway is slim.

But, spoiler alert: These things can totally happen.

The price to fix your shattered camera (or shattered femur) will undeniably cost more than what you’ll spend on travel insurance. There’s no worse feeling than being stuck with thousands of dollars in fees or medical bills—trust me, I know it from first-hand experience.

Yes, travel insurance is worth it, because traveling without it simply isn’t worth the risk. The honest truth is that if you can’t afford travel insurance, you really can’t afford to travel.

Does World Nomads Cover COVID-19?

World Nomads does not cover claims related to COVID-19, unless you end up in a medical emergency because of it (essentially meaning, if you happen to fall ill while traveling). There are a few companies out there who offer CFAR (Cancel For Any Reason) coverage, however the price does add up quickly. If this is a concern for you, I recommend doing some more research on COVID-19 travel insurance.

When Is the Best Time to Purchase Travel Insurance?

You can purchase a travel insurance policy days, weeks or even months before your trip starts. Some companies require that you purchase a plan several days before your trip starts, in order for the full coverage to take effect.

Purchasing a plan in advance is always a good idea. That’s largely because one of the biggest benefits of having travel insurance is trip cancellation coverage. If you haven’t purchased an insurance policy ahead of time, then you won’t be reimbursed for those unused travel costs.

But in between booking flights, checking hotel prices and planning activities, it’s sometimes easy to forget all about travel insurance.

In that case, World Nomads has your back. Not only are they one of the best companies on the market today, but they let you buy a policy after you’ve already left home.

In my experience, I typically see people buy travel insurance the day before they travel. It’s the “oh shit” item that most people forgot to pick up.

But if you know you’re traveling soon, and you already have the dates, don’t wait until the last minute. It’s better to CYA and pick some up while it’s still on your mind.

Who Is World Nomads?

First and foremost, something I feel it’s important to address is that World Nomads is not the underwriter for your insurance policy. They’re not the ones who insure you—they’ve built vetted relationships with underwriters and insurance providers around the world—and standardized their offerings—to match you with the right one based on your country of residence and final destination(s).

They’re like an OTA for travel insurance.

So with that said, and before we dive even deeper into this World Nomads travel insurance review, let’s get you introduced to the company in question.

World Nomads is an Australian-based insurance company that was started by a fellow backpacker (and now angel investor), Simon Monk. Founded in 2002, they’ve been protecting travelers for 17 years from over 150 countries by providing comprehensive coverage for every type of adventure.

But World Nomads is more than your average travel insurance provider. In fact, they go far beyond the call of duty by promoting responsible travel around the world.

For example, following the 2004 Southeast Asian Tsunami, World Nomads launched the Footprints Network. This non-profit organization allows travelers to make a micro-donation to the development project of their choice when purchasing an insurance policy.

In total, they raised over $4 million dollars to fund more than 200 projects.

Travel insurance that protects your adventure and the world? Now that’s something I can get behind.

Full Review of World Nomads Travel Insurance

Pros and Cons of World Nomads Travel Insurance

Pros

- Worldwide 24-hour Assistance: Emergency services are available 24/7, no matter where you are in the world. The customer representative is there to advise on next steps or point you towards the nearest hospital or authority. Not to mention, the folks on the phone are friendly, helpful and also professional.

- Online Policy Adjustments: If your trip changes for any reason, you can adjust your policy from anywhere in the world. So if you want to soak up the sun in Thailand for an extra few weeks, you can simply extend online.

- Extensive Activity List: Unlike most travel insurance companies, World Nomads automatically includes coverage for a variety of sports and activities. There’s no need to pay extra to protect yourself for different adventures.

- Easy Claim Process: World Nomads makes filing a claim as easy as possible. Through their online claim portal, you can upload your documentation and submit your claim in just a few clicks.

Cons

- Lack of Flexibility: You basically only have two plans to choose from. That means you’re stuck with the listed claim limits. You won’t be able to add extra benefits or increase the maximum policy coverage.

- Per Article Limit: Since you will only be reimbursed up to a maximum amount per item, you might not be able to claim the full amount of your belongings. Although the Explorer Plan has a higher per article limit, you’ll still be in the hole for expensive equipment or gear.

Who Is World Nomads For?

First and foremost, World Nomads was created by travelers for travelers. It’s specifically made for us globetrotters, wanderlusters and adventure-seekers. For this reason, I consider them to be the best travel insurance for backpackers.

Because, let’s face it, backpackers have different travel requirements than other travelers. You need a company that understands your lifestyle (and, especially in this case, your budget).

And to be honest, backpackers can also be a little reckless. That’s why you need extra protection for all those exhilarating activities. From cave diving in Mexico to bungee jumping (naked) in New Zealand, World Nomads has a comprehensive coverage plan for every one of your adventurous moments.

But they’re not only for backpackers. They’re a good fit for many other types of travelers, too.

- Long-Term Travelers: You can purchase up to one year of travel insurance coverage. That applies to both single- and multi-trip plans.

- Travelers Without a Set Plan: You can update your policy, destinations and travel dates on the go. Likewise, you can extend your coverage if you want to modify your trip or change your itinerary.

- Travelers Who Forgot About Travel Insurance: If you’ve already hit the road without insurance, don’t worry! You can still purchase a policy.

- Travelers Who Simply Want Peace of Mind: With extensive medical and baggage coverage, you’ll be prepared for whatever comes your way. Your time is better spent relaxing and having fun instead of worrying about worst case scenarios.

Who Isn’t World Nomads For?

In an effort to make sure this is a brutally honest and comprehensive World Nomads review, I’ll tell you straight up if they’re not the right company for you. While World Nomads is my favorite go-to provider for most scenarios, it may not necessarily fit the needs of every type of traveler.

- Senior Travelers: They only cover travelers under the age of 70. Senior travelers are better off purchasing a travel insurance policy with another provider, like Allianz Travel, which has no age limit for policyholders.

- Travelers with Expensive Gear: Because the “Per Article Limit” only reimburses items up to a certain dollar amount, you might not have full coverage for your expensive laptop or camera gear. In this case, InsureMyEquipment is the better option.

What’s Included in World Nomads Travel Insurance?

This wouldn’t be a complete World Nomads travel insurance review if we didn’t take a deeper look at the protection benefits offered with a World Nomads travel insurance plan.

Emergency Accidents & Sickness Medical Expenses

Your health is one of the most important things to protect when traveling abroad. From broken bones to food poisoning, you’ll want a comprehensive medical emergency policy to protect you while you’re in the hospital.

Without travel insurance, you could be stuck with thousands of dollars in medical bills. A good policy will include enough coverage for minor doctor visits to major surgeries.

Emergency Evacuation & Repatriation

In the case of an emergency—and we’re talking worst-case scenario here—there might be instances in which you’d need to be airlifted or flown to the nearest hospital. For example, if you break your arm in the middle of a desert safari, you’re going to need a helicopter rescue to pick you up and take you to a medical facility.

In a similar fashion, Emergency Repatriation will transport you back to your home country if you require further treatment. And in the unlikely event that you die overseas (fingers crossed you don’t), World Nomads will cover the cost of returning your remains back home.

Non-Medical Emergency Evacuation

Not all evacuations are caused by medical emergencies. If an earthquake or tsunami hits when you’re on vacation, World Nomads will cover the transportation costs to get you back home. Emergency Evacuation also applies to countries with civil or political unrest.

However, this benefit is not available for some United States residents. Refer to your policy for more information.

Trip Cancellation

Sometimes incidents happen before we even set foot on an airplane. If you need to cancel your trip before you leave, then World Nomads will reimburse your non-refundable travel expenses.

It’s important to note that you are only covered for a set number of reasons, as outlined by World Nomads. Some reasons include sickness, injury, death or illness of a family member, as well as unforeseen natural disasters.

A good rule of thumb is to purchase a policy that covers the entire cost of your trip.

Trip Interruption

If you hit a bump in the road while you’re already traveling, then Trip Interruption will reimburse the rest of your unused travel costs. The same stipulations listed for Trip Cancellation also apply to Trip Interruption.

Trip Delay

Trip Delay covers you in case you are unable to reach your destination on time for circumstances outside of your control. For example, if your flight is delayed for more than six hours, travel insurance will cover the unused accommodation expenses or pay for any additional expenses needed to get you where you need to go.

Baggage & Personal Effects

World Nomads also covers you for loss, theft and even damage to your personal belongings. So for instance, if you drop your sunglasses in the ocean or leave behind your camera in a taxi, you’ll be able to file a claim for reimbursement.

One thing to keep in mind is that World Nomads enforces its per article limit. Again, this means that you can only claim a certain dollar amount for each item. For example, if you lose your $3,000 laptop, you’ll only get back $500 with the Standard Plan, or $1,500 with the Explorer Plan.

Baggage Delay

World Nomads will also cover the costs if your checked baggage is delayed or left behind by the air carrier. You’ll receive daily compensation (up to $750) to purchase toiletries or whatever else you may need until your bag arrives.

Accidental Death & Dismemberment

Although dying or losing a body part on your trip is the ultimate worst case scenario, it’s good to know that you’re still protected by World Nomads. In this situation, Accidental Death & Dismemberment coverage will pay you or your family up to a certain amount.

Adventure Sports & Activities

Traveling and exhilarating adventures go hand-in-hand, and World Nomads has you covered for over 300 different activities. The list is quite extensive and includes almost everything under the sun from archery and dog sledding to cage fighting and hot air ballooning.

However, the type of covered activities will vary depending on the type of plan you purchase. You should consult your World Nomads policy to confirm if your planned activities are covered.

What’s Not Covered by World Nomads Travel Insurance?

Although travel insurance can protect you in many instances, it does, unfortunately, have its limitations.

Pre-Existing Medical Conditions

World Nomads does not cover any expenses related to a pre-existing medical condition. They have a pre-existing condition look-back period of 90 days which means you can’t file a claim for any condition you had 90 days prior to purchasing a plan.

Medical Check-Ups

General doctor visits are also not covered under your policy. This means you can’t file a claim for a routine physical exam or any other non-emergency related treatment or surgery.

When it comes to dental work, you are also not covered for cleanings, replacement fillings or other surgeries that are not considered urgent.

Extreme Activities

Although they cover a variety of activities that most backpackers are likely encounter, there are still some exclusions. For instance, activities like base jumping and solo mountaineering are not covered under your travel insurance policy.

Passport Coverage

If your passport gets stolen, lost or damaged on your trip, you will not get reimbursed for any expenses needed to replace it.

Although World Nomads won’t cover the costs, they’re still there to assist. The company can help you report the loss with local authorities and provide any necessary information needed to find or replace your passport.

Reckless or Risky Behavior

As with most travel insurance companies, you are not covered for incidents that occur when you are acting recklessly. For example, if you get into a motorcycle accident without wearing a helmet, then your medical expenses will probably not be covered.

The same goes with incidents that happen if you’re on drugs or have been drinking alcohol. If you show up to the hospital under the influence, then you’re stuck paying those fees out of pocket.

Be smart out there, boys and girls.

Personal Experience Using World Nomads

Several years back, I traveled to Xi’an China. I planned to teach English to hundreds of adorably rambunctious children. After spending time in New Zealand and Australia, I was eager to spend the next six months eating mouth-numbing foods, exploring the countryside and playing with cute kids in the classroom.

But I soon discovered that my body had other plans.

A routine medical exam uncovered that my uncomfortable stomach pains were actually gallstones. This was definitely not my idea of a good start to my trip. But since I was planning to stay in China, I knew I had to go under the knife sooner rather than later.

However, I wasn’t sold on the idea of having such a serious and potentially dangerous surgery in China. I heard one too many horror stories about unhygienic operation rooms and reused medical equipment for my liking.

So I decided to pop over to Singapore. There, the medical facilities are considered some of the best in Asia. And just three days later, the hospital released me happy, healthy and two gallstones lighter.

Although I had an operation in the most expensive city in the world, I walked away without having to pay a cent. And that’s because I had a policy with World Nomads. They covered my entire medical bill and hospital stay which racked up to be more than $8,000 USD.

So, take it from me—emergencies and accidents do happen. And, while we can’t predict what the future holds, we can prepare for the worst.

Although I can’t recommend my less-than-pleasant experience with gallstones, I can vouch for World Nomads. The company saved me a lot of financial stress—and possibly my life.

World Nomads Travel Insurance Plans

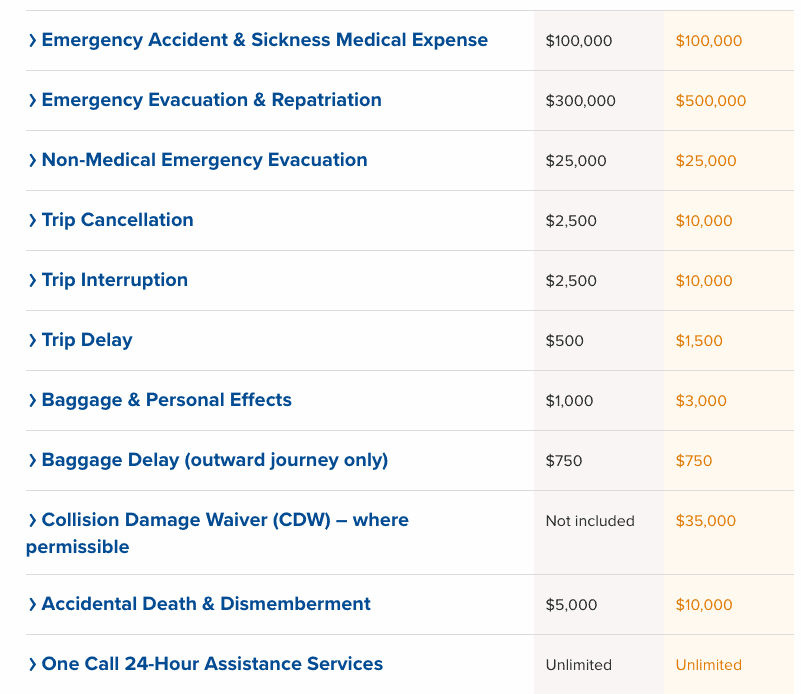

Included in this World Nomads travel insurance review is a breakdown of your plan options. When you sign up, you’ll have two plans to choose from:

- The Standard Plan – Best Option for Travelers on a Budget

- The Explorer Plan – Best Option for Travelers Looking for the Highest Coverage

While both plans cover the essentials, the Explorer Plan offers a slightly higher coverage limit, as well as a few extra add-ons.

Standard Plan

The Standard Plan provides decent medical and trip coverage for the average traveler. You’ll get $100,000 emergency accident and medical coverage, which I find is pretty generous for a basic insurance policy.

If you have to cancel or interrupt your trip, then you’ll receive up to $2,500 in reimbursement. And if your trip is delayed, say due to bad weather, then you’ll get $500 back with trip delay coverage.

Now, the Standard Plan comes with $1,000 in lost, theft or damaged baggage protection. However, you will only receive a maximum of $500 per item (up to a total of $1,000). So, if you’re traveling with expensive equipment or gear, keep in mind that the per article limit might not cover the entire cost.

When it comes to adventure, the Standard Plan includes protection for over 200 types of sports and activities. You should check World Nomad’s list of adventure sports to see if your activity is covered.

Explorer Plan

While the Explorer Plan is more expensive, it’s also more comprehensive compared to the Standard Plan.

The $100,000 emergency accident and medical coverage is actually identical to the Standard Plan. However, emergency evacuation and repatriation increases from $300,000 to $500,000. If you plan on traveling to remote countries with less-than-adequate medical facilities, this might make investing in the Explorer Plan worthwhile.

The Explorer Plan also includes higher trip cancellation and trip interruption coverage. Compared to the Standard Plan, World Nomads will reimburse you up to $8,000 more for any unused travel costs.

And if you’re traveling with expensive gear or electronics, then definitely go with or upgrade to the Explorer Plan. You’ll get three times the amount of policy coverage for baggage and personal items.

For adventure lovers, the Explorer Plan includes every activity on the Standard Plan, plus more. Whether you’re riding a snowboard or a mechanical bull, the Explorer Plan has you covered.

Plus, the Explorer Plan has another extra benefit that’s not included with the Standard Plan. That’s the Collision Damage Waiver. That means that, if you rent a car in a foreign country and get into an accident, World Nomads will cover up to $35,000 in damage fees.

World Nomads Travel Insurance Cost

The price of your travel insurance will depend on a variety of factors: your plan type, trip length, destination, your age and and your nationality.

As part of this World Nomads travel insurance review, let’s look at some scenarios to get a sense of how much a policy will cost you.

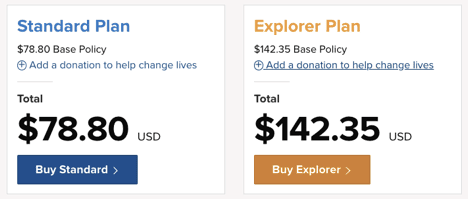

For the first example, let’s say you’re a United States citizen spending two weeks backpacking through Germany, Austria and Italy.

As you can see, the cost to insure your Eurotrip is $5.62 per day with the Standard Plan and $10.16 per day with the Explorer Plan.

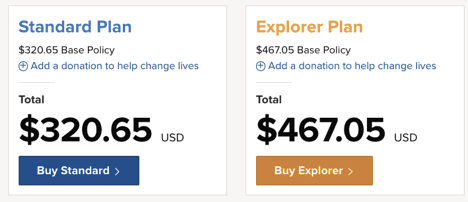

In this next example, you’re a United States citizen traveling to one of the most popular destinations on the backpacking circuit: Southeast Asia. You plan to spend three months visiting Laos, Vietnam, Thailand and Cambodia.

When you break it down, the Standard Plan works out to be $3.56 per day while the Explorer Plan is $5.18 per day. And there’s no price difference between visiting just one country in Southeast Asia, or all four.

So, for just several dollars a day, you can protect yourself against thousands of dollars in medical bills or cancellation fees. There’s really no excuse to not purchase a policy with World Nomads while traveling.

World Nomads vs. Travelex vs. Allianz Travel

By now you’ve probably realized that World Nomads provides excellent coverage for most travelers. However, you’ve probably also already seen some other names pop up during your search.

In order to help you weigh your options, as part of this World Nomads travel insurance review, I’ll be comparing World Nomads with two other popular companies: Travelex and Allianz.

World Nomads vs. Travelex

Travelex is another company based out of Australia. It’s a solid name in the travel insurance industry and they offer competitive benefits and prices.

But Travelex really stands out from the crowd due to its ease of customizability. For example, you can add or cancel protection for any reason. You can also add rental car coverage. And you will have access to medical upgrades for pre-existing medical conditions.

That said, World Nomads includes adventurous activities with even their most basic policy. Meanwhile, Travelex charges for this benefit. So if you plan to do any extreme sports on your trip, you’ll need to take this extra price into account.

World Nomads vs. Allianz Travel

Allianz Travel is one of the biggest names in the insurance biz. Because it’s the world’s largest travel insurance company, it can offer low and often unbeatable prices on many of their plans.

But while the price of the OneTrip Basic might be appealing, it lacks some of the necessary features that should be included in a good travel insurance plan. Medical coverage caps at $10,000 and medical evacuation only covers $50,000, which is far too low, in my opinion.

However, the company does have four different plans to choose from, which means there’s more flexibility when it comes to pricing and benefits. And on the plus side, Allianz covers pre-existing medical conditions for each plan.

I compared the lowest tier plans available for World Nomads, Travelex and Allianz. For this example, let’s look at a one-month trip to Thailand that is roughly valued at $2,000.

| World Nomads | Travelex | Allianz | |

| Plan | Standard Plan | Travel Basic | OneTrip Basic |

| Cost | $116 | $56 | $73 |

| Emergency Medical | $100,000 | $15,000 | $10,000 |

| Emergency Evacuation | $300,000 | $100,000 | $50,000 |

| Trip Cancellation | $2,500 | $2,000 | $2,000 |

| Trip Interruption | $2,500 | $3,000 | $2,000 |

| Baggage and Personal Belongings | $1,000 | $500 | $500 |

For the price, World Nomads has a higher than average coverage limit compared to Travelex and Allianz. Even the cheapest World Nomad’s plan comes with $100,000 of emergency medical and $300,000 evacuation.

That said, while I stand by my recommendation of using World Nomads for travel insurance, you might find that some of the other companies listed above better fit your needs and budget.

How to File a Claim with World Nomads

Hopefully, you’ll never run into any unexpected incidents on your trip. But if you do, then you’ll want to know how to make a claim in order to get reimbursed.

Document the Incident or Accident

In order for World Nomads to reimburse you for your claim, you will first need to gather all the necessary evidence to submit. And remember, it’s your responsibility for following up with the right authorities for the paperwork.

If someone steals your wallet, then you’ll need the filed police report. If you went to the hospital, then ask for the doctor’s paperwork. The more documentation you have, the more likely it is your claim will be accepted by World Nomads.

Make a Claim Through Your World Nomads Dashboard

The process to make a claim online is fairly straightforward. All you have to do is log into the website and answer a series of questions about the incident and attach any supporting documentation. That’s it!

Afterwards, your claim goes to World Nomads to review and process. If they have further questions or need more information, then they will contact you via email or telephone.

It may take several days to for them to review your claim, but once World Nomads approves your claim, you should receive your money back in five or so business days.

Final Thoughts

There are so many different travel insurance companies in the industry today. With dozens of competitors, plans and benefits to choose from, finding the best one may seem daunting. But after reading this World Nomads Travel Insurance review, I hope you feel more informed about what to look for and how to select a policy.

Whether you’re planning a short weekend getaway or a multi-country world tour, World Nomads offers pretty robust coverage.

So what are you waiting for? Now that you’ve read this World Nomads review, just click the button below to get your free quote and decide if it’s right for you.

World Nomads FAQs

-

What is the best alternative to World Nomads?

Heymondo, Faye, and SafetyWing are our top 3 alternatives to World Nomads travel insurance.

-

What is travel insurance?

Travel insurance is a protection policy that covers you in a variety of unexpected situations that might occur while traveling.

-

What should travel insurance cover?

Comprehensive travel insurance should cover trip cancellation, trip interruption, lost or stolen property, medical emergencies, and emergency evacuation

-

How good is World Nomads?

World Nomads is good, but we think there are even better travel insurance companies.

-

Is travel insurance necessary?

With travel insurance, you’ll be ready to tackle every type of travel mishap that comes your way. And just for this peace of mind alone, travel insurance is really worth it!