Looking to purchase a travel insurance plan from Allianz? Read this first! In this Allianz travel insurance review, I’ll help you decide whether or not they have an insurance plan that’s right for you.

Allianz Travel Insurance Review

There are many different travel insurance companies in the industry today. And with each provider offering different plans, benefits and coverage, it might be challenging to figure out which one is right for you. That’s why we put together this Allianz travel insurance review.

Not only do you need a reliable company, but also one with robust coverage and protection against whatever catastrophe is thrown your way.

That’s where Allianz Global Assistance travel insurance comes in. It’s one of the largest and oldest insurance companies in the industry. And, with multiple plans and benefits to choose from, it just might be the best option for your trip.

But it also might not be.

This Allianz travel insurance review will help you make a decision. Alternatively, we’ll help you figure out if one of the other of the best travel insurance companies might suit you better. Fill out the form below to compare plans and get a quote for your upcoming trip.

Is Travel Insurance Worth It?

Between the cost of flights and hotels, you may be wondering why you should spend even more money on travel insurance. After all, the chances of breaking your leg in a scooter accident or getting robbed on the train seem slim, right?

But the truth is: These things can happen to anyone. And they do.

And in these dire situations, you’ll be thankful that you have travel insurance by your side.

The cost to protect yourself with travel insurance is nothing compared to the exorbitant medical bills. And for this reason alone, travel insurance is worth it.

You might never have to use it. But travel insurance helps you prepare for the worst. As a wise man once said, if you can’t afford travel insurance, you can’t afford to travel!

When to Purchase Travel Insurance

You can purchase a travel insurance policy days, weeks or months before your trip starts.

However, the best time to buy travel insurance is after you finalize your travel arrangements. Travel insurance usually becomes effective the day after you purchase the plan. This means that you’ll be protected with trip cancellation coverage. That way, you’ll be reimbursed in case you need to change travel plans before you leave.

It’s also important to note that some companies require that you purchase a plan in advance. This is for the full coverage to take effect.

And with Allianz Global Assistance, purchasing a plan early has one significant benefit. Want travel insurance to cover a pre-existing medical condition? Then it’s recommended to buy a plan within 14 days of making your first trip payment. By booking early, you might qualify for a waiver that covers your pre-existing conditions while traveling.

So if you’ve already made travel plans, don’t wait until the last minute. By booking traveling insurance early, you can protect yourself against those pesky travel mishaps!

Who Is Allianz Travel Insurance?

Let’s first start by introducing you to Allianz Global Assistance. Even if you’re not familiar with their travel insurance policies, the chances are that you’ve heard about Allianz in general. Well, Allianz Global Assistance is actually a subsection of Allianz SE. It’s the largest insurance provider in the world today.

Founded over 120 years ago as a finance company, Allianz has grown to cover a wide range of services, including asset management and investment strategies. But the core of the company lies in the insurance business, with Allianz providing coverage for property, health, life and of course, travel.

But besides crunching numbers and providing insurance, Allianz goes above and beyond for local communities around the world. The Allianz Corporate Giving Program has contributed over $2 million and 16,000 volunteer hours towards programs to help students, seniors and dozens of employee-elected charities.

Above all else, travel insurance was created to protect you. But with the Allianz, you can feel good knowing that your insurance provider is there to protect others.

Who Is Allianz Global Assistance Travel Insurance For?

Before we dive into our Allianz travel insurance review, let’s discuss which types of travelers would benefit from their plans. With nine different plans to choose from, Allianz Global Assistance has comprehensive coverage for most types of travelers.

- Annual Travelers: With an Allianz annual plan, you can be protected for an entire year, no matter where or how many times you travel! Annual plans will save you money if you plan to take more than one or two trips during the year.

- Senior Travelers: There is no age limit for insurance policyholders, which makes Allianz an excellent option for senior travelers.

- Families Traveling Together: With Allianz travel insurance, children under 17 can travel with their parents for free on select plans. This is an excellent and cost-efficient benefit for families with one, two, or more kids.

- Business Travelers: Allianz Global Assistance is one of the few insurance companies to offer protection for business equipment. We know it’s stressful to lose or have something stolen, especially if it’s your boss’s!

Who Isn’t Allianz Travel Insurance For?

As part of this Allianz Travel insurance review, we think it’s also important to note that Allianz isn’t for every type of traveler. And while the comprehensive plans might work for some people, it may not fit the needs of everyone.

- Adventure Travelers: Allianz does not offer protection for any sort of extreme activity or sport. If you plan to engage in any thrilling activities, opt for World Nomads, which includes coverage for over 200 different extreme sports.

- Travelers Wanting High Medical Coverage: We always recommend traveling with at least $100,000 of medical emergency coverage. And none of the Allianz plans offer this amount of coverage. Sure you can’t predict if you’ll need emergency care when traveling. But you should always be prepared for the worst. If you come down with a severe illness, you might be stuck with thousands of dollars in medical bills. World Nomads, on the other hand, offers $100,000 in medical emergency coverage with both their plans.

What’s Included in Allianz Travel Insurance?

As part of our Allianz travel insurance review, we’ll be covering each of the protection benefits offered with your travel insurance plan.

Emergency Medical Coverage

Getting sick or injured abroad can do more damage than just ruining your vacation. But without travel insurance, it can also leave you with thousands of dollars in hospital bills and medical expenses.

With emergency Medical Coverage, you’re protected against everything from last-minute doctor visits to long-term hospital stays. So if you get food poisoning in India or catch the severe flu in Brazil, you’ll be reimbursed for any necessary medical costs.

Emergency Transportation

Allianz Global Assistance also covers transportation costs needed to get you safely to the hospital. So for instance, if you break your leg skiing in the Alps, you’ll need to be airlifted to the nearest medical facility for immediate care.

And in the rare instance that you need to be flown back home, emergency transportation will also cover those costs.

Trip Cancellation

If you need to cancel your trip before you leave, then trip cancellation coverage will reimburse you for any unused expenses, like flights or hotel stays.

However, your reason for canceling needs to be covered under the Allianz policy. Allianz has 26 covered reasons, including natural disasters, traffic incidents or sickness, death or the birth of a family member.

Trip Interruption

If you’re already on vacation but need to return home early, then travel insurance also has your back. Trip Interruption coverage reimburses you for the unused portion of your trip in case you need to return home early due to a covered reason.

And in some cases, you’ll also be covered for any extra costs associated with getting home, like booking a new flight.

Baggage Loss/Damage

Allianz Global Assistance comes with coverage for your lost, stolen or damaged personal belongings. For example, if your iPhone or camera gets stolen while you’re on a train, then your travel insurance policy will cover part of the cost.

Each plan comes with a different amount of coverage. And it’s important to note that there is a strict per article limit. With Allianz Global Assistance, you can only claim up to $500 per item. That means if you lose your $2,000 DSLR camera, you will only get reimbursed $500.

Baggage Delay

If your checked baggage is delayed or misplaced by the air carrier for more than 12 hours, then you’ll be covered by the baggage delay benefit. That means you will be reimbursed for any necessary toiletries or items you need to purchase until your bag arrives.

Travel Delay

Allianz Global Allianz also covers you in case you are unable to reach your destination on time due to circumstances outside your control. For instance, if your airlines cancel your flights due to bad weather, then the insurance company will reimburse you for any meals, transportation or accommodation costs.

It’s important to note that travel delay coverage kicks in only if you are delayed for six hours or more.

Change Fee Coverage

There might be a situation where you simply need to change the dates of the flight, rather than canceling the entire trip. If you have the AllTrips Executive, OneTrip Prime or OneTrip Premier plan, the plan will reimburse you up to $500 to cover the cost of the airline change fee.

Loyalty Program Redeposit Fee Coverage

With Allianz Global Assistance, even if you purchase flights or accommodation using miles or points, the company will protect you. The loyalty program re-deposit fee coverage redeposits your points in case you need to cancel your flight or accommodation for a covered reason.

Note that only the AllTrips Executive, OneTrip Prime, and OneTrip Premier plans come with the loyalty program redeposit fee benefit. All three plans cover up to $500 worth of frequent flier miles or loyalty program points.

Business Equipment Coverage

If you travel for work, you might be bringing along company-paid equipment like laptops, phones and other equipment. And if you lose or break this equipment on your trip, Business Equipment Coverage will reimburse the associated costs to fix or replace them.

However, the only plan to offer protection for business equipment is the annual AllTrips Executive plan.

Travel Accident Coverage

Also known as accidental death and dismemberment, the travel accident coverage pays you or your family if you get into an accident while traveling. This includes coverage against the loss of a limb, eyesight, or in the worst situation, death.

Rental Car Damage and Theft Coverage

For just $9 a day, annual plan holders can protect themselves against collision, damage, or theft of a rental car. With this coverage, you don’t need to take out an additional policy at the rental car desk!

This benefit is not available to all US residents. Please consult your Allianz Global Assistance policy for more information.

What’s Not Covered by Allianz Travel Insurance?

Allianz Global Assistance covers a wide range of accidents and incidents that might happen on your trip. However, there are several limitations to note when purchasing an Allianz Global Assistance policy.

Extreme Sports Coverage

Allianz Travel does not protect you against any high risk or extreme activities. This includes, but is not limited to, mountain climbing, bungee jumping, or scuba diving. If you want coverage for any adventurous activities on your trip, we recommend World Nomads travel insurance, which covers over 200 thrilling sports and adventures.

Pre-Existing Medical Conditions

Generally speaking, Allianz Global Assistance does not cover any pre-existing medical conditions while traveling.

The look-back period for a pre-existing condition is 120 days. That means that if you have a diagnosis or condition within 120 days of your trip, you cannot claim the medical bill as an insurance expense.

However, you may be able to get a pre-existing condition waiver if you purchase travel insurance within 14 days of making your first trip payment.

If you do have pre-existing medical conditions, we recommend that you check out Travelex insurance, which does indeed cover you. We have a full Travelex review for you to read up on.

Allianz Travel Insurance Review: Global Assistance Insurance Plans

While all Allianz Global Assistance travel insurance plans include some or all the aforementioned coverage, they each break down differently. For this Allianz Global Assistance travel insurance review, we’ll compare the different plan options available. Depending on your travel needs, Allianz offers nine different travel insurance plans to choose from.

If you need coverage for one trip, then you should purchase a single-trip plan. The five single trip plan options include:

- OneTrip Cancellation Plus Plan – Best Option for Travelers Who Don’t Need Medical Coverage

- OneTrip Emergency Medical Plan – Best Option for Travelers Needing Basic Medical Coverage

- OneTrip Basic – Best Option for Travelers on a Budget

- OneTrip Prime – Best Option for the Average Traveler

- OneTrip Premier – Best Option for Travelers Looking for the Highest Coverage

On the other hand, taking several smaller trips throughout the year makes an annual, multi-trip plan more cost-effective. Annual plans cover you for an entire year of travel, regardless of if you stay domestic or travel overseas. There are four annual plans to choose from:

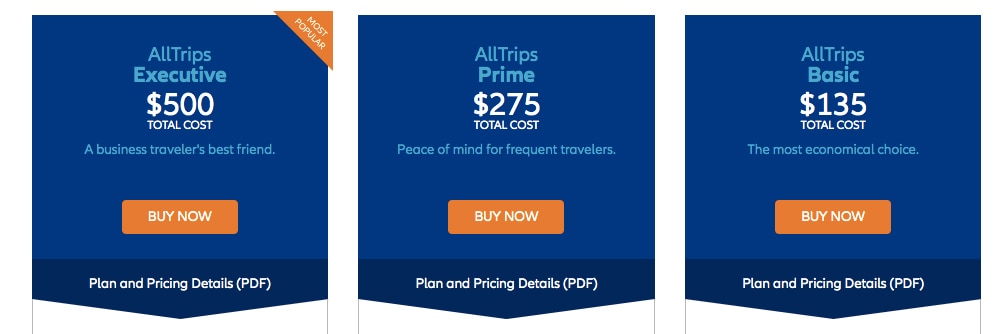

- AllTrips Basic – Best Option for Travelers Needing Basic Medical Coverage

- AllTrips Prime – Best Option for the Average Traveler

- AllTrips Executive – Best Option for Business Travelers

- AllTrips Premier – Best Option for Travelers Looking for the Highest Coverage

Besides the length of travel, there are a few significant differences between the single and annual-trip plans. For one, the annual trip plans only cover a set amount for trip cancellation or interruption. But with a single-trip plan, you’re covered for 100 percent or 150 percent of your total trip cost.

Another difference is that all annual plans offer Accidental Death and Dismemberment (AD&D) coverage, as well as rental car damage protection. The only single-trip plan to offer AD&D is the OneTrip Emergency Medical Plan. So, it’s essential to consider these factors when purchasing the right travel insurance policy for your trip.

-

The OneTrip Cancellation Plus Plan is Allianz’s most affordable policy. With this plan, you are only protected against trip cancellations, interruptions and delays. It’s important to note that medical coverage, medical transportation and baggage loss is not included.

And while you aren’t covered for trip cancellations, you do get $2,000 in baggage loss or damage coverage and $10,000 in accidental death or dismemberment. This plan is for anyone on a budget who is mostly concerned about interruptions to their travel plans, but not too concerned about all the rest.

-

If you are willing to forgo trip cancellation and interruption coverage, then the OneTrip Emergency Medical Plan is an adequate option for insurance. You’ll receive $50,000 in emergency medical coverage, as well as $250,000 in emergency medical transportation coverage.

Keep in mind that this plan only offers protection for medical expenses. If the airlines lose your luggage or if you need to cancel your trip, you will need to pay those expenses out of pocket. This plan is, therefore, for anyone who may be going on an adventurous trip and is mostly concerned about their health and safety, but is less so concerned with everything else.

-

Ideal for budget travelers who want to cover everything from medical needs to flight cancellations, the OneTrip Basic plan provides coverage against getting sick, needing medical evacuation or having to cancel your trip.

Included in the OneTrip Basic plan is $10,000 of medical and dental coverage and $50,000 worth of medical evacuation. And while that may sound like a lot, it might not cover your entire evacuation cost, especially if you need to be airlifted back home. For that reason, you might consider a more comprehensive policy if you plan to travel abroad or to a remote country.

The OneTrip Basic plan also reimburses up to $500 for lost or stolen baggage and $200 for delayed baggage.

But best of all, the OneTrip Basic plan will reimburse the full cost of your trip if you need to cancel or leave early. In fact, each single-trip plan with Allianz covers 100 percent of your expenses for trips up to $100,000. However, the reason for canceling needs to fall within Allianz Global Assistance’s list of covered reasons.

It’s important to note that there are a few limitations to the OneTrip Basic plan. Unlike the other Allianz Global Assistance plans, the OneTrip Basic plan does not include coverage for missed connections or airline change fees. And, there are fewer covered reasons for trip cancellation.

-

The OneTrip Prime plan is the most popular option for the average traveler. You’ll get $25,000 worth of medical and dental coverage along with $500,000 worth of emergency evacuation coverage.

When it comes to lost and stolen baggage, the OneTrip Prime plan includes $1,000 in coverage. However, you will only receive a maximum of $500 per bag or item (up to $1,000 total). That means if you’re traveling with expensive gear, the lost baggage coverage might not cover the entire cost.

You’ll also get $300 in baggage delay costs, $800 in missed connection coverage, and up to $250 for airline change fees. Those are pretty generous bonus benefits!

And if you cancel, you’re covered for 100 percent of the unused total trip cost. But if you need to leave early, OneTrip Prime also reimburses up to 150 percent of the trip cost. That means you won’t have to worry about increased transportation costs to get back home!

-

If you’re looking for the most comprehensive coverage option, then the OneTrip Premier plan is for you. It nearly doubles all the coverage amounts of the OneTrip Premier plan and includes a few extra benefits.

Medical and dental coverage doubles from $25,000 to $50,000, while emergency evacuation coverage also increases to $1,000,000. With international evacuation averaging around $100,000, this amount is more than adequate to cover your transportation back home.

You’ll receive up to $2,000 in lost or stolen baggage. But similar to the OneTrip Prime plan, you can only claim a maximum of $500 per item (up to $2,000 in total). The OneTrip Premier plan also includes $600 in baggage delay, $1,600 in travel delay, and $1,600 in missed connection coverage.

-

The most affordable multi-trip plan is AllTrips Basic. This plan includes $20,000 in emergency medical coverage and $100,000 in emergency transportation coverage.

But one of the biggest drawbacks is that the AllTrips Basic plan does not come with trip cancellation or interruption coverage. Remember that means you will not be reimbursed in case you are unable to go on your trip!

However, you are covered up to $1,000 for lost or damaged baggage, $200 for baggage delay and $300 for travel delay. The AllTrips Basic plan also comes with rental car damage and theft coverage up to $45,000.

-

The $20,000 emergency medical coverage and $100,000 emergency transportation coverage with the AllTrips Prime plan is identical to the AllTrips Basic plan. The baggage loss, baggage delay and travel delay coverage are also the same.

However, the AllTrips Prime plan includes $2,000 coverage for trip cancellation and $2,000 coverage for trip interruption. If you want to be protected for any possible trip changes, then make sure to purchase an AllTrips Prime, Executive or Premier plan.

-

Catering to the business traveler, the AllTrips Executive plan includes comprehensive medical and trip coverage along with a few extra benefits. Emergency medical coverage increases to $50,000, and emergency transportation rises to $250,000. You will also receive $5,000 in trip cancellation and trip interruption coverage.

And unlike the other plans, the AllTrips Executive plan comes with business equipment coverage. So if you travel throughout year for work, your work laptops, phones and other electronics are protected against theft or damage.

-

Although the AllTrips Premier plan is more expensive, it’s also more comprehensive compared to the other annual travel insurance plans. You’ll be covered for up to $50,000 in emergency medical and $500,000 for emergency medical transportation. This plan is for those with a bigger budget.

The AllTrips Premier plan also includes $2,000 in trip cancellation and interruption coverage and $1,500 in travel delay coverage. On top of that, you also get $50,000 in travel accident coverage if you lose a limb or your eyesight when traveling.

Allianz Travel Insurance Cost

The cost of your travel insurance policy depends on factors like your age, residence state, trip length and total trip cost.

Let’s look at several examples to determine a likely policy price.

In this first scenario, you’re a 28-year-old backpacker from Washington State who’s planning to spend a month traveling around Thailand. The total value of your trip is roughly $2,000, including the flight and hostel.

The cost breaks down to $4.06 per day for the OneTrip Basic plan, $4.56 per day for the OneTrip Prime plan and $6.16 per day for the OneTrip Premier plan.

Although the difference in cost may be small, you’ll receive more benefits with the OneTrip Prime and Premier plans. For instance, the coverage amount for medical emergencies, evacuations and travel delay is higher than the OneTrip Basic plan.

But let’s say you also plan to travel to Ecuador, China and Hawaii later in the year. Instead of purchasing additional single-trip plans, you can invest in the annual plan to save on travel insurance costs.

The AllTrips Prime plan costs just under a dollar per day and protects you on all trips for a year! Although coverage slightly differs between the OneTrip and AllTrip plans, you’ll save money in the end instead of purchasing four individual single-trip plans.

In this next example, you’re a 25-year-old Californian road-tripping around Europe for two months. Although you plan to visit Italy, Austria, Switzerland and France, you’ll spend the majority of your time in Germany. Between flights, trains and hotels, your trip costs around $5,000.

For your Eurotrip, you can expect to pay $5.26 per day for the OneTrip Basic plan and $5.95 for the OneTrip Prime plan. And if you want the most comprehensive travel insurance coverage, you can pay $6.60 per day for the OneTrip Premier plan.

So you can protect yourself against enormous medical bills and travel incidents for just a few dollars a day. You’ll have full coverage and peace of mind!

Pros and Cons of Allianz Travel Insurance

Pros

- Variety of Plan Options: Depending on your travel insurance needs, you’ll have nine different plans to choose from. Whether you’re taking one dream vacation, or traveling throughout the year for work, Allianz Global Assistance has a wide range of insurance options to fit your needs.

- Free Family Coverage: The OneTrip Prime and Premier plans, as well as the AllTrips Premier Plan, includes coverage for children under 17 at no additional cost.

Cons

- Low Coverage with Some Plans: We recommend at least $100,000 in medical emergency and medical transportation coverage. And while some of the more comprehensive plans have adequate medical transportation coverage, the highest amount of medical emergency coverage you can have is $50,000.

- No Extreme Sports Coverage: When you’re on vacation, you might want to participate in fun and exciting activities, like skydiving, hiking and snorkeling. However, Allianz Global Assistance does not cover these activities.

Allianz vs. Travelex vs. World Nomads

This Allianz Travel Insurance review wouldn’t be complete without looking at competitors. Depending on your travel needs, Allianz Global Assistance might be a suitable travel insurance provider for your trip. But for this comprehensive Allianz Global Assistance travel insurance review, it’s important to look at other what other companies offer in terms of benefits. We will compare Allianz Global Assistance with two different providers:

Travelex

Based out of Australia, Travelex provides comparable coverage for Allianz Global Assistance for roughly the same price. Both offer medical upgrades for pre-existing medical conditions and rental car damage protection.

But while Allianz Global Assistance offers nine travel insurance plans, Travelex allows for more customizability. For example, you can add different benefits to your Travelex insurance plan, including cancel for any reason protection.

Travelex also offers a paid upgrade for extreme sports and adventurous activities. That is missing from Allianz Global Assistance policies.

World Nomads

Created with backpackers and travelers in mind, Australian based World Nomads is one of the most popular names in the travel insurance business.

However, one of the biggest downsides to World Nomads is the cost, especially if you plan to travel multiple times throughout the year. For an annual plan, Allianz Global Assistance’s most comprehensive plan is still half the cost of the basic World Nomads plan.

You can’t customize World Nomads as much as Allianz Global Assistance, as it only offers two plans. However, World Nomads offers a higher maximum amount for emergency medical reimbursement. Both World Nomad plans come with $100,000 in coverage. This is twice as high as Allianz Global Assistance’s most comprehensive plan.

On top of that, World Nomads includes extreme sports coverage with the price of the plan. So if you’re planning on scuba diving or bungee jumping on your trip, the insurance will completely cover you in case anything goes array.

How to File a Claim with Allianz Travel Insurance

If you run into an unexpected incident abroad, you’ll want to know how to file a claim with Allianz Global Assistance. This way, the insurance will reimburse you for any medical bills or lost expenses you incur.

Document the Incident or Accident

When it comes to filing a claim, gathering the appropriate documentation is one of the most critical steps. It’s your responsibility to follow up with the right authorities. It’s also on you to collect the necessary paperwork for submitting a claim.

Consult the Allianz Global Assistance claim documentation checklist to see exactly what forms and documents you need in order to submit your claim.

File the Claim Online

As part of this Allianz Travel Insurance review, let’s dive into how to file a claim. Filing a claim with Allianz Global Assistance is relatively easy. You can do it entirely online or on your mobile device. You’ll enter details about the incident and attach your supporting documentation to the claim.

However, it’s very important to note that you have only 90 days to submit the claim with Allianz Global Assistance. They may have further questions about the request. If so, they’ll contact you for more information via email or telephone.

It may take around 10 business days for them to review your claim. If the company accepts your claim, it’ll pay you by check, debit-card deposit or direct deposit.

Final Thoughts

There are dozens of travel insurance companies on the market today. But finding the right provider for your needs doesn’t have to be complicated. One of the biggest names, Allianz Global Assistance is an excellent option for travelers looking for short- or long-term coverage, as this Allianz Travel Insurance review suggests.

Allianz Global Assistance will cover you for those unpredictable and unforeseeable events. From broken camera lenses to broken bones, you’ll feel a little more comfortable traveling the world with insurance to protect you.

But don’t just take our word for it. Get your free quote and see if Allianz Global Assistance is right for you.

Allianz FAQs

-

Is Allianz travel insurance legitimate?

Yes, Allianz is a legitimate and well-trusted travel insurance provider.

-

Does Allianz pay claims?

Yes, Allianz has a good reputation for paying out claims.

-

What is travel insurance?

Travel insurance is a protection policy that covers you in a variety of unexpected situations that might occur while traveling.

-

Is travel insurance necessary?

With travel insurance, you’ll be ready to tackle every type of travel mishap that comes your way. And just for this peace of mind alone, travel insurance is really worth it!

-

What should travel insurance cover?

Comprehensive travel insurance should cover trip cancellation, trip interruption, lost or stolen property, medical emergencies, and emergency evacuation

We purchased Allianz flight insurance through American Airlines for flights for an Oceania cruise. After Oceania cancelled the cruise due to the coronavirus we tried to get reimbursed for the unusable airline tickets, but Allianz said they do not cover coronavirus-related cancellations.

Hey Eric,

Sorry to hear you had that experience. Check out this post on COVID-19 travel insurance for more info: https://travelfreak.com/coronavirus-travel-insurance/