International money transfers are impossibly expensive. In this TransferWise review, I’m showing you why it’s the best option for sending and receiving money all over the world (note: it’s better than PayPal and wire transfers)!

Wise Review (Previously TransferWise): Send Money Internationally and Pay Bills Abroad for Just 1%

Sending and receiving foreign currency used to be my biggest headache. In this Wise review (formerly TransferWise), I’m going to show you exactly why it’s now a complexity of the past.

When I was working and traveling in Australia, paying bills and sending money back home was nearly impossible. My wages were going into a foreign account, but I couldn’t use my foreign card to pay bills in the United States.

I couldn’t find a practical way to transfer the money between my accounts, or even to send money to my family and friends back home.

I tried transferring money from my foreign account to my US account via bank wire, but I was getting charged $35 every single time.

I tried using PayPal with multiple accounts hooked up to different cards in different countries—which was clunky at best—and I still had to deal with their criminal exchange rate.

And Western Union not only took days but they charged something like $50-$100.

Wise Review

Like many expats and long-term travelers, I was on the other side of the world with no way to send, receive or transfer money at a reasonable rate. The banks had me locked out. It should have been so easy, but it wasn’t.

Instead, I watched the banks take hundreds of dollars in fees while I worked my ass off to afford my travels.

I first heard about Wise last year and I now use it to send money to friends, to pay bills abroad, and even to accept payments from my international clients. I send and receive money all over the world, to and from any account, in any currency, at the official conversion rate, for a flat fee of about 1%.

It’s almost revolutionary. And in this Wise review, I’m going to tell you why this is the best way to send money abroad, bar none.

What is Wise, Anyway?

Wise was launched in 2011 as TransferWise, and has been backed by Peter Thiel (co-founder of PayPal, board of Facebook, an investor in Airbnb and Stripe) and Richard Branson (Virgin Airlines, Virgin Records, Virgin everything).

It’s made by two Estonian fellas: Kristo Käärmannone, financial consultant, and Taavet Hinrikus, the first ever employee at Skype. They’ve got some serious street cred, and with $117 million in funding, they’ve got the money behind them to make Wise a household name.

It’s my hope that, by using Wise, you’ll be able to spend less at the bank and more on your travels.

How Does Wise Work (and Why Is It So Cheap)?

Traditionally, sending money has involved a middleman—the bank. You give the money to them, they convert it, take their commission, then send it to the recipient.

But with Wise you exchange currency with other customers.

This is the cool part: Wise operates like a peer-to-peer service. Rather than exchanging money with the bank, you exchange money with a peer—someone else who also wants to use Wise to send money overseas. It cuts out all the fees (and it’s totally secure).

Pretty neat, huh? Technically, your money never even crosses a border, which is why they don’t have to charge you for the conversion.

Wise Review: Different Ways to Use the Service

The problem with a lot of money transfer services is that they only do one thing—they transfer money. Wise, however, is surprisingly versatile. Here are a few examples of how I’ve used them in the past:

- Transferring Money Between Accounts – Since I have bank accounts in multiple countries, I use Wise to transfer money between them. All I have to do is enter the bank details of each one and Wise initiates the transfer at the real conversion rate, only charging a minimal fee.

- Paying Bills Abroad – Wise makes it easy to pay bills from overseas, no matter which country you’re in. Just enter the business info and their bank information/IBAN number and they take care of the rest.

- Sending Money to Friends – Last year when I was in Bangkok, my friend Ben lost his bank card. Since he didn’t have any money on him, he logged online and sent me €400 with Wise. He paid €4 in fees, and I received the exact amount in my bank account in US dollars (within 24 hours and at the official exchange rate). I then withdrew Thai baht at the ATM and Ben could finally afford his dinner once again (though I obviously lent him enough to pay for dinner and a few beers in the meantime).

- Invoicing Freelance Clients – As a blogger, I do business with clients all over the world. I’ve found international wire transfers to be one of three things: costly, confusing, or unreliable. With Wise, I can send a simple money request to a client, who then initiates a standard bank transfer to Wise.

Because Wise has a bank account in each country, it’s technically a local transfer for the client and a local transfer for me, so they charge just 1%. The best part is that my clients don’t even have to sign up for an account, and neither one of us has to pay large fees! It’s all very simple.

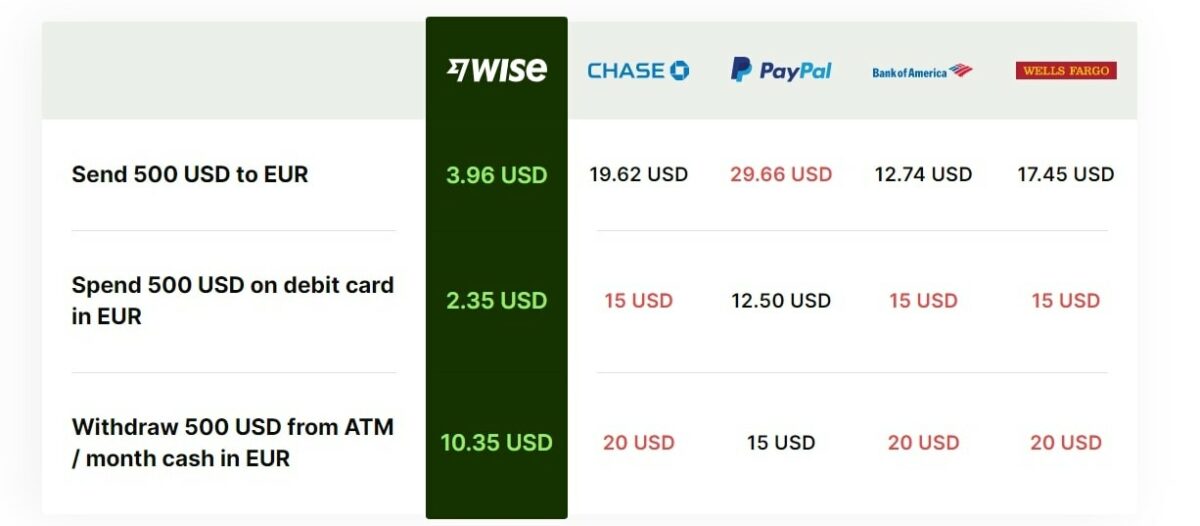

Wise vs. PayPal vs. The Bank

For years, PayPal has been the big player when it comes to sending and receiving money online. Since a lot of people have a PayPal account these days, it’s the go-to option because it’s just plain easy. But is convenience worth paying 6.9%?

Not only do they charge about 3.9% to send money, but they charge you an extra 3% on top of their already criminal exchange rate. Once you have the money in your account, they force you to convert the currency with them. It’s locked in your PayPal account and you can’t withdraw it unless you use their conversion rates.

Sneaky buggers.

I’ll be honest, I used to be a big fan of PayPal, but I’ve come to despise them. For a long time they’ve been the only option, and even today I’m forced to use them a lot to run my business—they’re a necessary evil. I was really excited to find Wise because it means I can phase PayPal out of my life.

The other difficulty with PayPal is that, if you want to transfer money between your own banks, you have to sign up for multiple accounts. Since you’re only permitted to have one PayPal account per country, you have to log in and out multiple times, and you’re still stuck paying the excessive exchange rate.

With Wise, you pay about 1% per transfer. So if I send $1,000, the fee is about $10. With Paypal, it would cost $69. Using an international bank transfer, sending $1,000 could cost up to $100 in fees. It’s kind of a no-brainer.

So What's the Catch with Wise?

That was my first question, too. I’m so used to getting cheated by banks that I couldn’t understand why a company would charge reasonable fees. It’s the peer-to-peer functionality that makes Wise cheap (not to mention it’s really clever). Rather than having to constantly convert currency, Wise is matching up users from around the world, and it’s totally secure.

Realistically you don’t see anything that happens behind the scenes. I’m not searching for a guy named Markus to make an exchange with. Wise has a huge pot of money to draw from in each country, so you don’t have to worry about waiting for someone else to make a transfer, too. The platform is set up to operate like a traditional money transfer service—just enter the recipient and the amount, and press send.

And here’s something else: in most major currencies, Wise allows you to send money using your credit card as the funding source. And all they charge is 1%!

That definitely beats PayPal’s 6.9% and the bank’s hefty cut.

Wise FAQs

-

How trustworthy is Wise?

Wise is a trustworthy solution for transferring money overseas quickly and without hefty bank transfer fees.

-

Is Wise better than PayPal?

Wise offers significantly lower fees than PayPal, which is a big deal if you are traveling overseas long-term.

-

Is Wise a good way to receive money?

Wise is a great way to receive money if you want to avoid PayPal’s high fees.

-

Is Wise legal in US?

Wise is totally legal to use in the US.

-

Does Wise report to the IRS?

Wise reports transfers to the IRS when they are legally obligated to do so.

Hi there,

What Theme do you use on the site

Awesome Write-up! Thanks for sharing! I share your frustration with Paypal. Especially, with Paypal… Having to open a separate account for each country is pretty lame as you have already highlighted. I will definitely check out Transferwise. Happy Travels!

Really well explained. I use Transferwise every month, they always give me the best rates.

However just to be fair and honest, you should mention that if 3 people use your link you will get £50 for referral.

Not saying you don’t deserve it after taking time to write such a good article!

I got really excited until I realized they don’t support Chinese yuan…….. I’m not even sure if the Chinese government would allow this anyway.

I was using transferwise until my friend gave me Currency Fair. Over 500€ the fee is less than Transferwise.

Great article! Transferwise is amazing. It’s saved me so much money on my international transfers to my family in the US. I’ll be using never a bank again.

Thanks for the article.

Thanks for all the explanations! I’m living in Taiwan and PayPal is only allowed with only one local bank with expensive fees! I’m happy to fall on your article comparing PayPal and Transferwise. Great job! Many thanks Jeremy!

I hope it saves you some money!

Beware that if you use credit card with Transferwise, your credit card company may also charge you for a “cash-like transaction”. I used Barclaycard to make a Transferwise transfer and Barcaycard charged me 3%. This is in addition to the Transferwise charge, obviously. You still get the better mid-market rate from Transferwise, but check if your credit card will charge for this or use a debit card.

my question relates to using Transferwise to make purchases: Paypal provides a guaranteed service..ie if one doesn’t receive the item paid for, or it is not as described, then PayPal refunds your money & investigates. I have had this happen 3 or 4 times when buying products from overseasa..& each time PayPal came through & I wasn’t ripped off. Ive just purchased a $2000us item overseas & the company is giving me the run around. Does Transferwise help in these situations?

Hey Asa. PayPal does offer an escrow service & protection for when you purchase products, but this isn’t what TransferWise is intended for. It’s used for sending and receiving money, not for buying things online. Hope that helps, and good luck with that company!

The idea is excellent!

My only concern is the safety related to both sender and the recipient’s ID’s.

Is it at the level of any financial or public insitution in the sender’s home country?

TransferWise is a private company, so it doesn’t operate at the level of a financial institution.

but i don’t see TWD?

TransferWise is an inexpensive online wire service, but it comes with a bag of administrative regulations that make sending money from from point A to point B unnecessary complicated. Strongly suggested to use a different wiring service even if it’s a little bit more expensive. Sometimes the cheapest is not the best option. Not recommended.

What kind of regulations? I’ve never had a problem!

I’m using TransferWise now to make a simple transfer to Turkey. It’s been over 5 days now and I am still waiting for the money to be credited to the account. It may be cheap but it’s not fast.

Sorry to hear that! I believe there are different methods of transfer which all take different amounts of time.

Really well explained. Super easy, quick and reliable. Highly recommend.

Hi there.

Any update on your case? Hope you finally received the money.

I’ve been using TranserWise from almost 4 years now and I can proudly say there has been no problems with it. Though I think it takes time sending money to England but generally it’s good for me in terms of everything.