Every traveler knows the pain of a depleting bank balance. We spend enough money just getting around the world—there’s no reason to spend even more on unnecessary bank fees.

When you use a standard issue debit card abroad, the bank typically charges a foreign transaction fee, usually somewhere in the vicinity of 3%. So, if you want to spend $100, it’ll actually cost you $103 (at least).

The situation is no better if you choose to withdraw cash at an ATM, either. Most banks charge a fee to withdraw from an out-of-network ATM, and the ATM itself might charge you a fee, as well. So when you withdraw cash abroad, you could end up getting double charged for fees, sometimes up to as much as $10 for a single withdrawal (I’m looking at you, Australia)!

While some of the fees might seem small at first glance, they add up quickly and, before you know it, you’ve wasted hundreds of dollars on bank charges (and, okay, yes, also really cool pants and one or two faux leather bracelets and, fine, a bongo).

The solution? Withdraw loads of cash at once, carry it all with you, and make it last as long as possible, right?

Wrong.

However careful you think you are, carrying a lot of cash while you travel is never a good idea. Money can (and will) get lost or stolen no matter how prudent you are—and when you’ve got it on you, you may be more likely to spend it on stuff you don’t need, too.

You see the dilemma?

Unfortunately, the world of international banking is a complex labyrinth for the average Joe (and even the above-average Joe). Most of us just go to our local bank, open up a checking or debit account and call it a day without ever thinking about international charges.

But bank fees can make a pretty big dent in your budget.

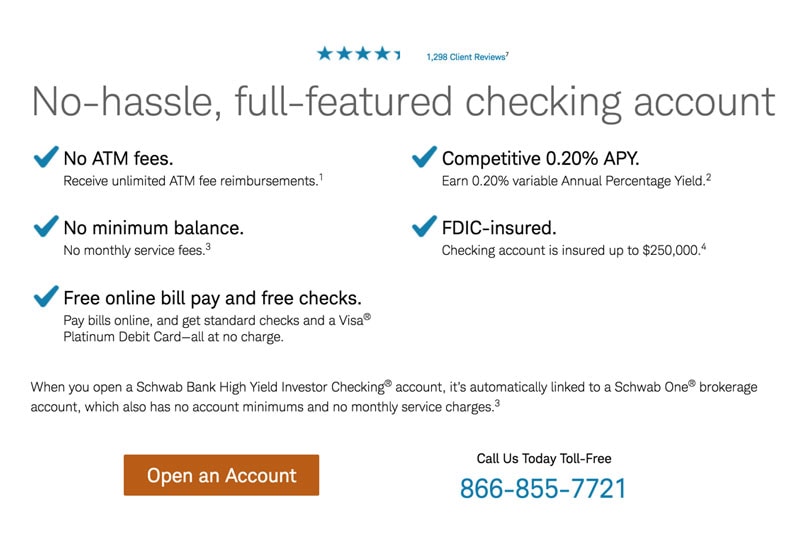

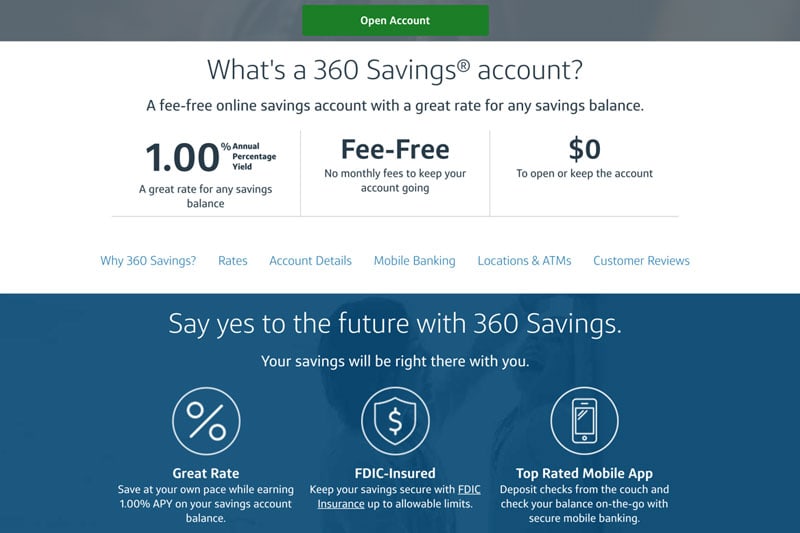

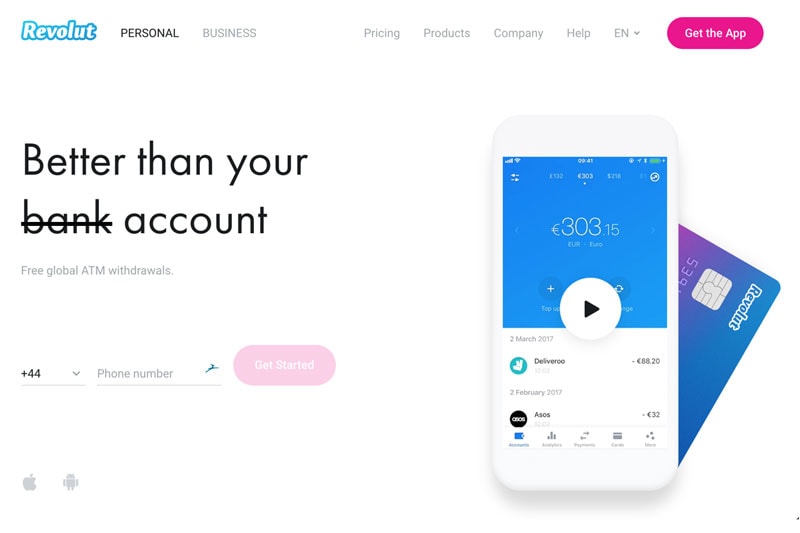

However, there are a few banks out there that are serving travelers all over the world well. Finding the right bank account is one of the best travel tips I can offer you. These are the best bank accounts for international travelers from both the US and UK.

Great roundup of services. Based on what you wrote, I am interested in both TransferWise and Revolut (note that I haven’t used either personally, though I already use Schwab and love it). So, I just did a little extra research on both and want to share what I learned.

For TransferWise, since the conversion rate is a fixed percentage, larger transfers will become quite expensive compared to using a bank that offers a maximum free structure. But, for smaller amounts, it does seem to be far better.

The Revolut marketing copy is all kinds of obfuscation. If you read just the main pages, you might think there are no fees, but there are many exceptions. Notably:

1. If transferring to a bank outside the EU or not transferring in euros then the transfer will be sent via SWIFT and you might incur international wire transfer fees. The beneficiary bank could also charge a fee to receive your transfer. And, when your money is in transit, it might be processed by an intermediary bank who might also deduct a handling fee. All these fees can be significant but hidden until too late.

2. If you make a cross-currency transfer, you’ll be charged 0.5% on any amount exceeding your £5000 monthly free foreign exchange allowance.

3. THB and RUB incur a 1.5% markup on the exchange rate.